3 Ways to Build Wealth

5 Levels of Financial Freedom by Jerry Robinson

The Financial Order of Operations by The Money Guy

Dave Ramsey’s 7 Baby Steps

This chart may be a few years old but it's extremely shocking. In todays dollars it takes $50,000 to $60,000 a year for a retired couple to live comfortably. That number will be substantially higher when my retirement starts. With social security, Medicare, and other entitlements going insolvent its important for the younger generation to save all they can. I don't plan on collecting social security in my 60s and if I do it won't cover much of anything.

Investing for the Long Term

Here are some options available for you when it comes to retirement accounts. If you are under the age of 50 and earn less than $117,000 as an individual or less than $194,000 as a married couple, a Roth IRA should be the first place you put your investable assets. This vehicle is so appealing since you have no taxes due upon withdrawal. For those under 50 years old the maximum amount you can contribute is $6,000 per year. For individuals over 50 the maximum contribution is $7,000. Remember money can be put in that account until tax day the following year. For example, you can contribute to your Roth 2020 account until April 15th of 2021. If you are fortunate enough to maximize that account, you can open up a traditional IRA and contribute to it. I have experience with Vanguard as my investment company. Management fees are the very low and they offer many different vehicles to put your money to work.( www.vanguard.com ) Other institutions that can offer Roth IRA accounts include: TRowe Price, Fidelity, Scottrade, and Charles Schwab.

Compounding Your Wealth

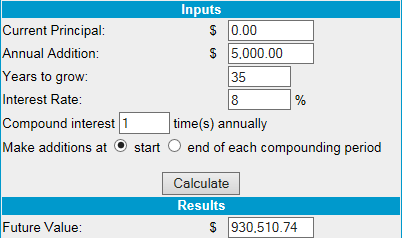

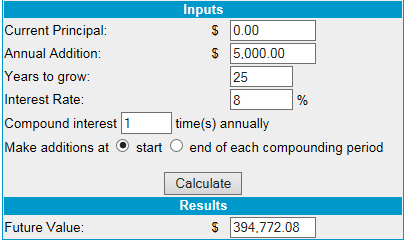

More experienced investors realize the value of starting your investment plan at an early age. For younger individuals compound interest is the best thing working for you. Look at what you can achieve by steadily saving money for the long term. Lets say you are 25 years old and you plan to contribute to a retirement plan until the age of 60 ( left chart). Lets see how much $5,000 saved each year at 8% can net you. Then lets compare that to starting contributions at the age of 35 and stopping at 60 years old. (right chart)

The charts above show you the power of time and compound interest. The link below will allow you to enter your own figures. http://www.moneychimp.com/calculator/compound_interest_calculator.htm

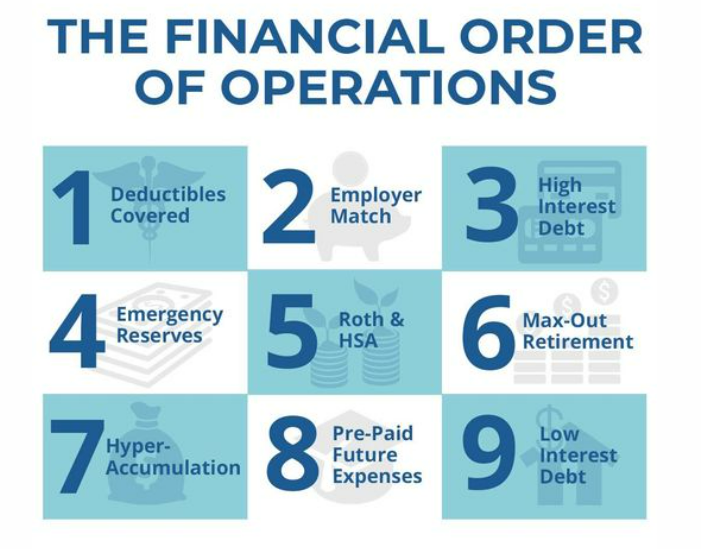

Order of Operations for Saving for Retirement

If you work for a company who offers a 401k my suggestion would be to take the maximum match your company offers and no more. Don't burden yourself with saving all your money in this vehicle. Right now tax rates are at all time lows when withdrawing money out of these accounts. In the future I see 401ks getting hit with a higher tax rate of withdrawals.