Why you should own precious metals

Knowing my opinion on central banks, fiat money, and fractional reserve lending it should come as no surprise I am a fan of precious metals.

Some investors look at them as an investment, while others use them as an insurance policy. I think a 5-10% hedge on your assets would be a good idea at this time.

At the moment the gold to silver ratio is 80:1. This means silver is undervalued and it is a good time to buy. When the ratio drops to 45:1. that makes gold a better deal.

The gold to silver ratio fell to a 32:1 ratio in 2011 and 17:1 in 1980. It is my personal opinion I think that ratio will drop well below 20:1 as this precious metals market continues to run. That would mean if gold hit $5,000 in the future, silver could be price at $250.

Steve Penny launched The Silver Chartist Report in 2019 and has become very popular. It is the most cost effective way to follow the gold, silver, and uranium markets at a reasonable price. Steve is one of the best all around guys out there.

Check his site out at The Silver Chartist

Keep track of the price of the metals at www.goldprice.org

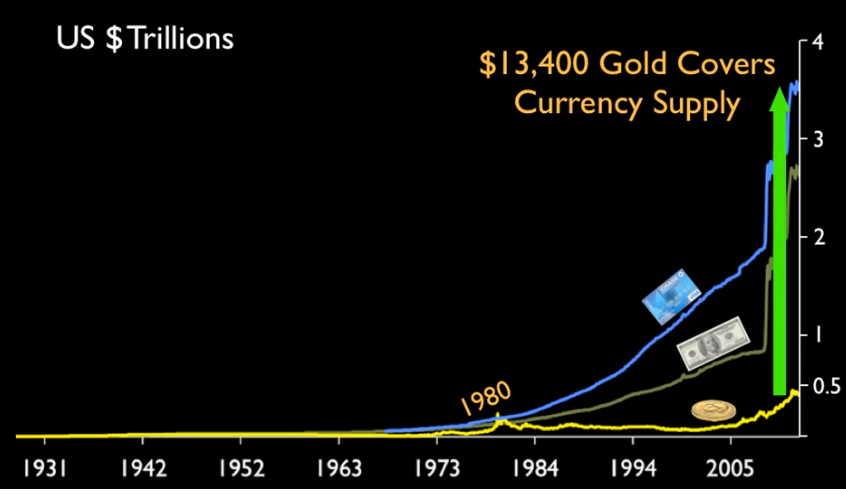

Gold always accounts for the expansion of the money supply. It did in 1980, when gold reached $850. I believe it will do it again, except this time the price will be much higher.